Quick understanding

- A good 672 credit rating is recognized as being good of the VantageScore and FICO scoring activities.

- With a good credit score, you may have a whole lot more financial potential and be accepted for much more beneficial rates.

- You could potentially enhance your 672 credit score with uniform, healthy financial activities.

Credit ratings is actually an essential tool accustomed assist have demostrated your own creditworthiness. Let’s learn exactly what your 672 credit rating function below.

Information and handling their borrowing

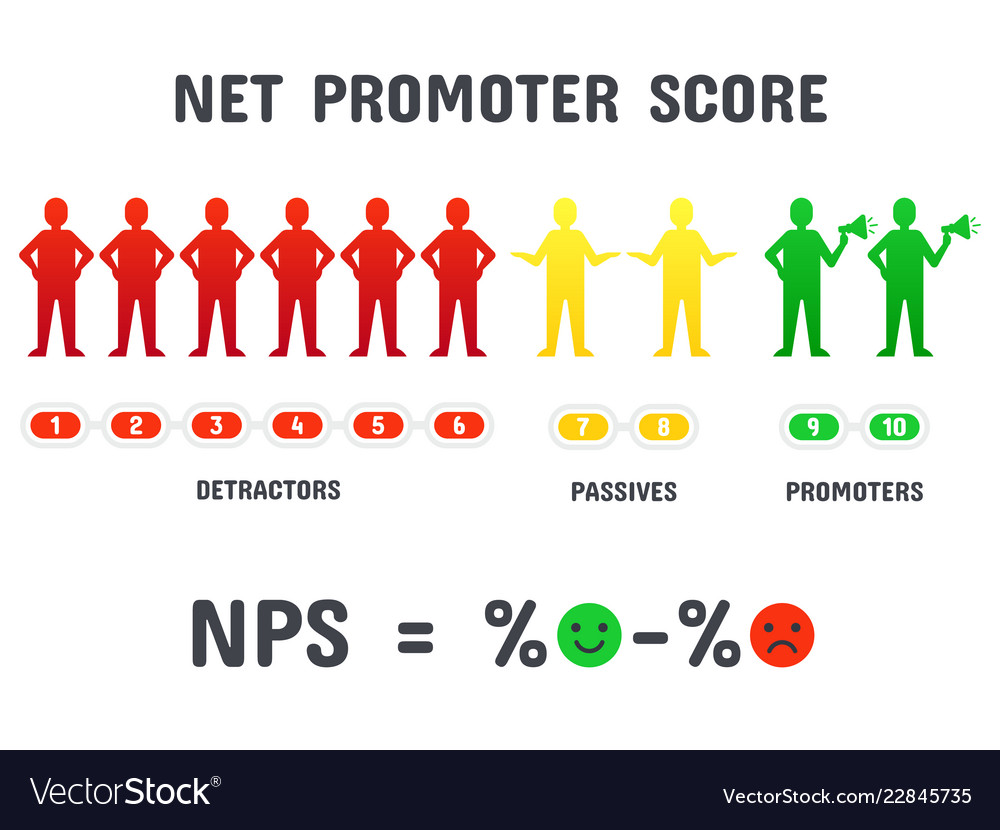

A credit rating try an effective about three-digit matter one is short for your creditworthiness. It is utilized, one of additional factors, of the lenders to evaluate the possibility of lending currency to you, the brand new borrower. A higher credit score implies a lower life expectancy risk, which may help you qualify for loans and you can positive interest rates. Credit ratings usually start from three hundred to help you 850, but according to the scoring model made use of, people numbers you’ll get into additional credit reporting classes. Below, i falter the 2 main scoring activities as well as their respective credit rating ranges.

- Excellent: 781 to help you 850

- Good: 661 so you can 780

- Fair: 601 in order to 660

- Poor: 500 so you’re able to 600

- Sub-standard: three hundred in order to 499

- Exceptional: 800+

Considering one another rating models’ range, a rating out-of 672 falls in good credit get assortment. While this often means as you are able to become a lower exposure in order to lenders rather than somebody having a reasonable or poor rating, it is critical to observe that other lenders could have differing requirements. In addition, you may find you to definitely an even higher get could result in down annual percentage rates (APRs), large credit restrictions plus.

Fico scores are influenced by several products, and but not limited to percentage history, borrowing from the bank use and you can length of credit history. Skills these types of activities can help you build advised behavior to keep up and extra replace your score.

Exactly what a great 672 credit score form

Basically, a credit history out-of 672 is considered to be good for each other head credit rating habits (between 661 in order to 780 to possess VantageScore and 670-739 getting FICO). This means your odds of having the ability to pick a home and take aside a car loan is actually more than someone having a credit score in a diminished range. You additionally tends to be recognized as a lowered risk applicant to possess that loan, and therefore you based a certain amount of credit score and you will possess managed the borrowing from the bank intelligently and you will be much more probably to get more beneficial conditions.

To find a house which have good 672 credit score

Buying property that have a good 672 credit score could be you can, it can be more challenging than if you had a keen excellent credit score.

All you pick, very carefully remark and you can contrast more lenders and you can financing choices to select your best complement your specific things. While Hollywood loans you are essential, credit scores are only among the activities loan providers fool around with when approving home loans. Typically, some lenders may require a larger downpayment, charge high rates or has actually more strict mortgage terms to possess mortgage candidates they might believe on the an excellent diversity.

Getting other credit lines having a 672 credit score

With a credit rating off 672, you may be recognized for several kind of credit, nevertheless requirements and you will words you’ll are very different depending on the financial as well as your overall monetary profile. Fico scores are very important, but there may be other factors to look at also, particularly:

Enhancing your credit score increases the probability of getting a great line of credit with an increase of advantageous terms. Let’s mention a number of the methods do this below.

Providing boost an effective 672 credit score

Remember that no matter your goals, improving a credit score will take time. It’s also possible to find it fall and rise as you remain on your own path to enhancing your creditworthiness. This is typical. Will still be patient and you can patient on your way of including best practices for financial health since you continue to work toward enhancing your score.

To close out

Strengthening an optimistic credit history does take time and you may healthy economic patterns. Whether you’re simply getting started in your economic excursion or keeps seen ebbs and you will streams on your get, an effective 672 credit rating lands about a beneficial a number of the latest Vantage and you can FICO designs. But not, you could potentially always assist in improving your own score acquire more good financing conditions of the constantly applying healthy monetary habits.